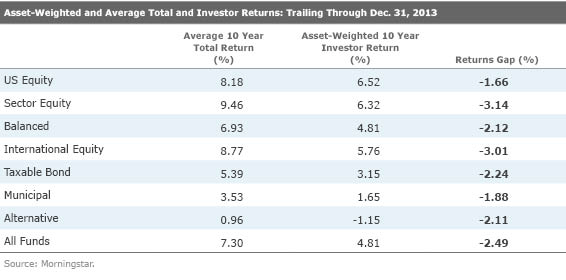

If the latest data from Morningstar[1] (US) is anything to go by, Behaviour Gap seems to be getting wider and wider. For the uninitiated, ‘behaviour gap’ or ‘performance gap’ is the difference between the return of a fund and the return an average investor in that fund actually gets. Morningstar’s research shows that this gap has ballooned to a mind-blowing 2.49%pa by the end of 2013, up from 0.95% ten years ago.

This table shows the performance gap for major fund sectors:

This research is based on US investors but there is every indication that the picture for UK investors would be very similar. A 2010 working paper[2] by the Cass Business School showed that performance gap for an average UK equity fund investor around is 1.2% a year over the 9-year period ending 2009. Another 2007 research by Lukas Schneider [3] showed that the performance gap was as much as 2.43%pa for UK smaller companies funds and 2.06%pa for growth funds.

Behaviour Gap and Adviser’s Alpha

Accordingly, it has become a key area of value add for advisers to help clients close or reduce the performance gap. As the work of psychologist Daniel Kahneman and others suggests, it’s much easier to recognise other people’s behavioural failings than our own. Thus, helping clients to deal with the ‘behaviour gap’ by being the voice of reason in extreme market conditions, should be a much easier sell for advisers than chasing fund managers’ alpha. Indeed a new whitepaper by Vanguard[4] suggests that the discipline and guidance that an adviser provides through behavioural coaching adds an estimated 1.5%pa net return, when compared to an average DIY investor, and could be the largest potential value-add by advisers. In other words, it is potentially a stronger value add than asset allocation, fund selection and, even tax planning!

My question is, as planners, are we taking this seriously enough? Are advisers really less likely to make the same behavioural mistakes that investors/clients make? Is behaviour gap for clients working with advisers less than those who don’t? Of course, the answer will vary from adviser to adviser, but taken as a profession, is this an area we actually do better than DIY investors? If what we read in trade press is anything to go by, I worry that it’s very difficult to come to that conclusion.

I had a lively exchange with a number of financial planners on Twitter the other day about this survey that suggests that US planners were shifting ‘clients’ assets out of equities and into cash because clients’ risk tolerance plummeted’ Notably the survey was ‘fielded during the first week of February, as equity markets were sliding.’ Is this what the same behaviour that leads to performance gap? What am I missing?

Take for instance this research by ARC here in the UK, which suggests that looking back, clients in DFM portfolios suffered as a result of being switched into defensive portfolios during the financial crisis and consequently missing the rebound that followed. These clients were presumably working with advisers or directly with DFMs, yet that didn’t stop them from piling high on equities in the run up to financial crisis and then panic-selling during the crisis. Classic behaviour gap story, which makes me ask the question, are we failing clients? If they trust us to be the voice of reason and to stop them doing dumb with their investments, especially in extreme market conditions; isn’t it worrying that we make the same mistakes and then charge clients for the privilege?

Blaming Clients’ Tolerance for Advisers’ Behavioural Gap

Of course changes in clients’ risk tolerance is often blamed for this. The suggestion is that a client’s risk tolerance changes with market movements, so they are expected to be more bullish in rising markets and less so in falling ones. However, the best evidence available, including data from FinaMetrica, using actual clients’ scores[5] suggests that risk tolerance is a deeply ingrained psychological trait and tends to be quite stable through different market conditions. Indeed the report notes that ‘clients’ risk tolerance scores remained remarkably stable through the most turbulent market conditions in living memory’ (Thanks to Paul Resnik for sharing this during our various banters on Twitter and for doing more than anyone else I know to enlighten us all on the subject!)

Paul also tells me that as an industry, our understanding of risk tolerate is pretty dire and what’s often confused for risk tolerance is in fact ‘risk perception’, which of course changes with market conditions. And that an adviser’s job is to help clients reconcile this conflict, not a knee jerk response to their greed and fears, which invariably is what leads to behaviour gap.

This shows how big of problem behaviour gap is and how incredibly difficult it is for even professionals to avoid it, let alone clients. Nonetheless, it is remains an area that good advisers can add value. It also appears many people in the profession aren’t taking it seriously enough, which makes it a point of differentiation for those can demonstrate to clients that this is one area they are adding value. Currently, I’m not aware of any data or tool that enables us to measure advisers’ value add in closing the behaviour gap, but given what US-based Betterment has been able to do with data so far, I believe that, in time, this will become available. In fact, it’s not impossible to foresee a future where every investor statement will show a personalised behaviour gap! When, not if, that happens, it’ll be crystal clear who is delivering ‘behaviour alpha’ and who isn’t. There’ll be no place to hide.

[1] Mind the Gap 2014 by Russel Kinnel, Morningstar. https://news.morningstar.com/articlenet/article.aspx?id=637022

[2] Clare & Motson (2010) Do UK retail investors buy at the top and sell at the bottom? (working paper) Centre for Asset Management Research , Cass Business School

[3] Lukas Schneider (2007) “Are UK Fund Investors Achieving Fund Rates Of Return? An examination of the differences between UK fund returns and UK Investors’ returns.” PhD Thesis, July 2007.