I read this article on AdviserLounge by Julia Kollewe, apparently a financial reporter for The Guardian and The Observer

‘Many independent financial advisers talk a good game but when you dig deeper it becomes pretty obvious that they have only a cursory understanding of economics and the markets.’

Julia goes on to make a point about QE and how it has driven down bond yields, as though this is some profound insight.

She goes on to say….

‘But how many IFAs are aware of this broader, and arguably crucial, development within fixed income — and have adapted (their client portfolios) accordingly? How many make the link between the end of QE and the impact that will have on the performance of bond funds – so-called ‘safe’ assets?

Given the vast spectrum of investment advice IFAs are allowed to give, it is perhaps not surprising that they tend to gravitate towards standardised portfolios, rather than investments tailored to the changing macro-economic – and market – climate.

But does this really constitute robust, and quality, financial advice?’

Really? Whoever says standardized portfolios can’t be tailored to changing macro economic climate? Where did she get that? Her ignorance beggars belief!

I’m not quite sure what the criteria are for being a ‘financial journalist’ this day and age, it appears intellectual rigour is certainly not one of them, because that’s what Julia’s article lacks. If you are going to make derogatory comments about an entire profession, least you could do is to offer some sort of evidence to support your claims. But Julia offers no data, no reference something or someone to corroborate her claims of IFAs’ supposed ignorance of macroeconomic issues or indeed that economic clairvoyants are any good at making judgement calls when it comes to investing.

Unfortunately for Julia, we all have access something called The Internet and deluge of anecdotal evidence to discredit her claims. Personally, I feel very strongly that these sorts of views should be challenged and thrown into the bin where they belong.

First, the suggestion that economists and financial pundits are better than ordinary folks (let alone financial advisers) at making investment calls is simply not true, and market predictions are more often than not, plainly wrong.

I suspect Tim Harford is a far more discerning journalist than Julia. He had this to say about the astonishing record of complete failure of economic forecasts.

CXO Advisory collected data of 68 top experts and tracked their forecasts on the US stock market between 2005 through to 2012. It found 42 of the 68 gurus had accuracy scores below 50%, and the average market prediction offered by these experts has been below 50% accuracy. Turns out, a coin toss is a far better predictor than market pundits!

Stanford University psychologist and author of Expert Political Judgement, Philip Tetlock tracked 28,000 forecasts by hundreds of experts in a variety of domains and found the average expert was only slightly more accurate than a dart-throwing monkey. He also found absolutely no correlation between the accuracy of their forecast and having a PhD, being an economist or even access to classified information! The more bullish they are about their forecasts, the more likely they are to be way off the mark.

More to Julia’s specific point about low bond yields! Really, this is stale news; it’s been debated over and over again for the last 3 years or so. Every investment committee I sit on debated this issue until we were bored to death.

Many advisers would recollect fund groups had this same message coming out of their ears 3 years ago! In 2011, around 2 years after the Fed and the BoE commenced their QE programmes, virtually every economic and market commentary had something to say about the impending bond bubble. The Bond King, aka Bill Gross had dumped US Government bonds and fund managers on this side were almost unanimous in their views that holding Gilts, especially long dated Gilts was probably not a good idea. 3 years ago!

And many firms did listen and reduced their Gilt allocation, but here’s the thing; 3 years later, the Bond King was reportedly ousted in part due to the underperformance and subsequent outflow for getting it completely wrong on US Treasury Bonds.

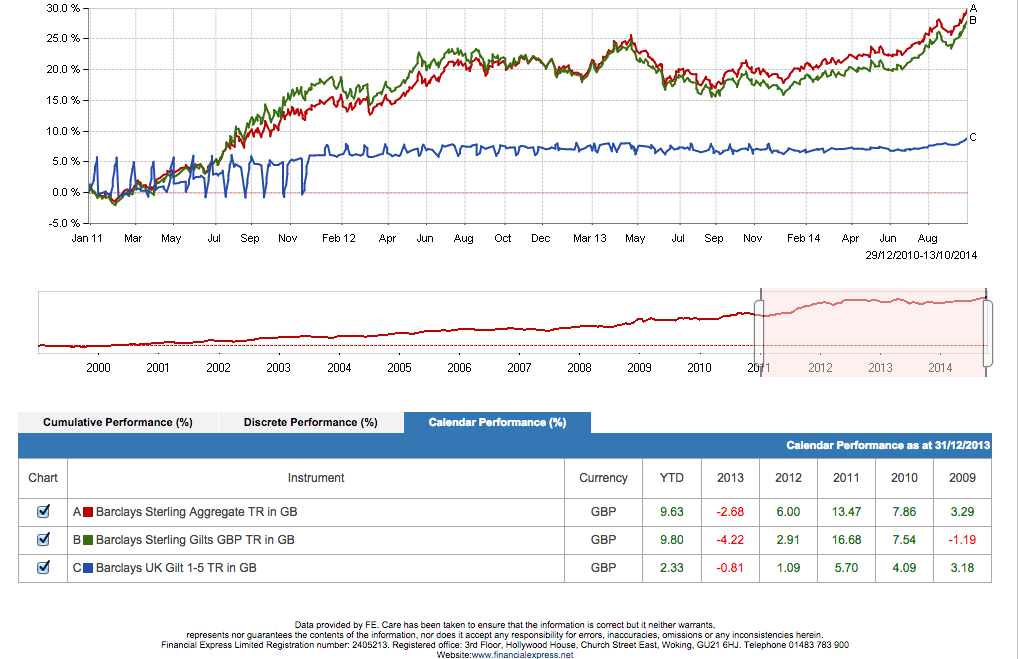

And what about Gilts? Well I’ll let the numbers speak…

As you can see in this chart, Gilts and Sterling fixed interest in general defied expectations over this period (bar modest drops in 2013) and remain one of the best performing asset year till date. What’s going to happen next, well your guess is as good as mine! But people like Julia are fixate on the current low yield and think they know something that everybody else don’t. She apparently knows exactly what you should and shouldn’t be holding it in your portfolio, nevermind the reasons or time horizon for holding them.

The sad thing is that our regulatory system allows folks like Julia to tell investors what they should and shouldn’t do with their portfolios without actually taking responsibility for anything. Here my advice to Julia, stick to consumer journalism! But if you are going to write for adviser audience and make ill-conceived claims like this one, you better have damn good evidence to support your claims or prepare to be shot!

Rant over. We can all go back to the important job of looking after clients.

Well said, Abraham.

I have had a bit of fun reading your article. Poor Julia!!!

The truth is we don’t know if the interest rates will raise next year and how the yield curve will react to it. The Bank of England’s Governor is trying to prepare us for a raise in interest rate but God knows what events we may have next year (apart from the expected elections).

Even if the interest rates will raise, let’s say by 0.50%, this will not mean that the yield’ curve will move parallel. It could well be that long duration yields will not change at all and the yield curve will become not so steep moving towards a flatter curve. History told us that usually the short duration yields grow higher than medium and long duration yields when interest rates grow, but we don’t know. Long duration yields are a good measure for inflation and it seems so far inflation stayed low: food is getting cheaper (thanks to Lidl and Aldi who forced Tesco to slash prices), petrol as well. So far wages have not picked up, so increase in earnings are sluggish.

My clients’ portfolio usually have a 6 years duration with around 4.5% yield. If the rates increase by 0.50% next year and the curve will move parallel I will lose 3% capital and get the 4.5% yield giving the clients a 1.5% per annum return.

But what if Europe will drag us back into recession? Probably more QE will need to be employed by the Bank of England dragging the yields even lower towards the 2012 levels. I could actually make a capital gain for my clients.

See, we don’t know.