One of the more common misconceptions about the ”Safe Withdrawal Rate’ framework is the impact of fees; advice fees, fund expenses and platform charges. An example of this gross misconception was recently shown in this article which slams percentage fee model for retirement planning as ‘broken‘. The article notes

CWC Research managing director Clive Waller points out a 1 per cent charge combined with a 4 per cent withdrawal rate equates to the adviser charging 25 per cent of the client’s income.

He says: “One-off fees are tolerable but if they are ripped out every year in retirement they can look horrible. That potentially raises TCF issues. “In my opinion the current in-retirement fee model is broken.”

I pointed to Clive on Twiter that the extensive research on sustainable withdrawal rate framework shows that the impact of fees of withdrawal rates isn’t directly proportional; as in it’s inaccurate to assume that 1% of fees reduces withdrawal rate by 1%. But he’s having none of it;

Sorry. If withdrawal = 4% and fee = 1%, then fee as % of income = 25%. No amount of financial alchemy changes that.

— clive waller (@clivewaller) February 12, 2016

Now, I’ve got a lot respect for Clive Waller. But on this occasion, not only is Clive just plainly wrong by the power of simple arithmetic, empirical data makes this inaccuracy rather glaring..

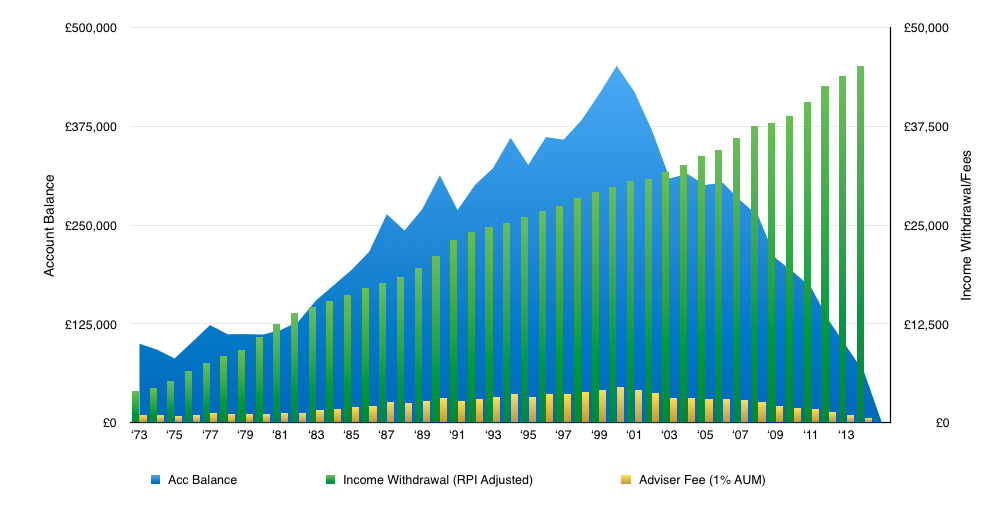

To demonstrate this, I constructed a simple 50/50 portfolio (50% MSCI Global + 50% Dimensional Global Short Dated Bond). I applied an initial withdrawal rate of 4% i.e £4,000pa which is then adjusted for inflation (RPI) and also applied a 1%pa fee to the asset under advice. With an initial balance of £100,000, I ran the data from Jan 1973 until the portfolio ran out of money in Dec 2014. The graph below shows the relationship for between income withdrawal, account balance and the fees.

Over the 42 year period, the cumulative income withdrawal is £1,004,592 and the total fee taken is £98,749, which by the power of simple arithmetic amounts to around 10% of the total income.

Closer look at the data shows that, over the first 10 years, cumulative fees totaled £9,522 compared to cumulative income withdrawal of £68,785, meaning 1%pa fee amounted to 13.8% of income withdrawal. Over 20 and 30 years, 1%pa fee amounted to 12.9% and 13.3% of cumulative income withdrawal respectively.

So while Clive point that 1%pa fee is 25% of the 4% withdrawal is correct in the first year of retirement, over a typical retirement period of 20 to 40 years, under the SWR framework, the impact of fees is a much lower percentage. The explanation for this is that, under the SWR framework, income withdrawal is adjusted for inflation, which means the income goes up over time and as the account balance is depleted over time, the impact of %-based fee is reduced.

There is no alchemy here; just arithmetic. It’s historical returns data, inflation data and excel spreadsheets. How can anyone argue with that?

Join us for more in-depth discussions about this at the Science of Retirement Conference 2016!

Let’s be clear; fund, platform and advice fees do impact on sustainable withdrawal rate. However, because the SWR framework is based on the worse case scenario in historical market data, as the account balance reduces over time, so does % based fees. But the example I used in this model isn’t even such a terrible period to start your retirement, as a 4% rule (plus 1%pa fee) would have actually survived a 40 year retirement period, without running out of money. Yet, the cumulative effect of 1% fee on income withdrawal was 10%, not 25% as Clive suggested!

Obviously, if the portfolio performs exceptionally well and inflation remains particularly low ( good luck with that one), fees could increase as the account balance goes up, but such a scenario would be uncommon, and in any case client would/should actually take a much higher withdrawal if they are enjoying such a favourable portfolio performance.

Accordingly, to account for the impact of fees, researchers recommend reducing SWR by 0.45% for every 1% fee. i.e with a 1% fee, SWR of 4% is reduced to 3.55% to account for the impact of fees.

This approach is supported by is by Pye (2001) and Kitces (2010). Pye studied the impact of expenses by measuring how SWR changed if the expected return for investments was reduced for an implicit expense ratio and found that found that a 1% expense ratio translates into a SWR decline of 0.5%; thus, for instance, the 4% withdrawal rate based on index returns might be reduced to a 3.5% withdrawal rate after an 1% investment advice fee.

Kitces (2010) also found that for balanced portfolios, each 100 basis point increase in investment expenses translated approximately 45% of that cost into a reduction in the withdrawal rate (e.g., a 1% expense ratio translated into a 0.45% reduction in the safe withdrawal rate.

This is because the withdrawal rate is adjusted for inflation over time, and ultimately spend down principal, changes in returns do not necessarily translate 1:1 as reductions in the withdrawal rate. More importantly, the fact that the percentage-of-assets-based fees itself recalculates and naturally adjusts downwards as a portfolio is spent. Accordingly, while fees may have been equal to 25% of withdrawals in year 1, the fees are only 1% of the withdrawals in year 30 in a spenddown scenario.

Fees are very important and should be challenged. I am not a huge fan of percentage based fees but the more I think about it, percentage based fee model may actually be the ideal fee model for drawdown portfolio. The natural self-mitigating effect – where investment fees are higher in favourable environments but lower in spend-down scenarios – dampens the impact of investment expenses on withdrawal rates.

The other issue I took with the article was that it seems to suggest that there is no need for ongoing advice for a drawdown portfolio and so no need to pay ongoing adviser fee. Again this is dog poo because managing a drawdown portfolio is never a set-and-forget process and ongoing review is crucial. For instance, implementing a dynamic withdrawal strategies such as the Guyton-Klinger rules can improve sustainable withdrawal rate to as much as 5.5% but it requires careful ongoing management. Not only that, managing the vagaries of decisions such as cash buffers or optimising withdrawals based on tax wrappers, requires careful, ongoing consideration.

The idea that clients should go on some sort of pay-as-you-go service at the exact time when ongoing management is crucial should be not even be entertained.

.