One clear indictment of asset managers in the FCA interim report is the regulator’s verdict on closet indexers. Closet indexers are funds charging active management fees for what amounts to a little more than merely tracking an index. The FCA’s term for this phenomenal rip-off is ‘partly active,’ which it defined as active funds with a tracking error of 1.5% or less.

The regulator estimates that a whooping 42% (£142bn in assets ) of retail active equity funds are closet indexers, of which £109bn are considered expensive i.e. charging more than 0.50% for clean share class or 1% for bundled share class.

![]()

The regulator concluded that:

Expensive ‘partly active’ funds are unlikely to deliver value for money.

Partly active products in general may be suitable for investors who wish to achieve returns similar to the market, but if they are priced at ‘active’ levels these products are unlikely to generate value for money for investors.

Figure 6.5 shows that there are a significant number of partly active share classes with substantially higher charges than equivalent passive products. Investors in these relatively expensive partly active products would likely achieve better value for money from switching to a cheap passive fund in the same investment category.

![]()

So What?

Let’s be clear about what’s going on here; investors in these closet index funds paid the managers to achieve specific objectives, often expressed in terms of beating a benchmark. While there is of course no guarantee, the fund must be different than the benchmark to have any chance of meeting the objectives. It’s statistically impossible for a manager to beat a benchmark by merely tracking it.

[bctt tweet=”It’s statistically impossible for a manager to beat a benchmark by merely tracking it.” username=”AbrahamOnMoney”]

But these managers couldn’t even be bother to get their fingers out. By charging active fees for what amounts to little more than merely tracking the benchmark, these managers hoped to achieve statistical impossibility.

These closer indexers wilfully mislead investors. The managers charged investors exorbitant fees without even trying to deliver the outcome they promised.

Imagine the kind of public outcry that will erupt if water companies charged us without having water pipes or any other means of getting the water to our homes. Or if mobile phone companies charged exorbitant fees without having any network coverage. Or train companies with no trains but sold us tickets.

This is exactly what closet indexers do. They charge investors for service which they have no means or intention of delivering.

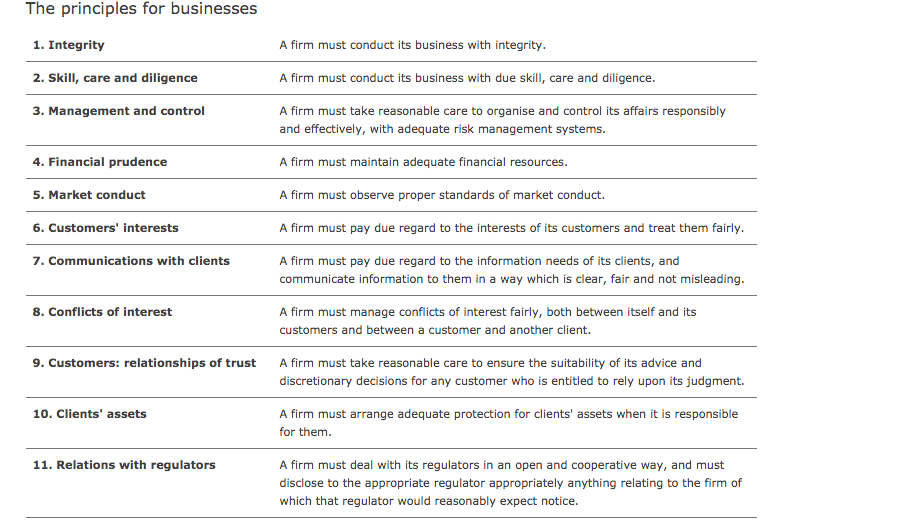

By charging investors an arm and a leg for this statistical impossibility, closer indexers breached FCA’s first rule – integrity! They breached at least 4 of the 11 principles set by the FCA for the firms it regulates including on skill, care and diligence, customers’ interests and relationship of trust.

[bctt tweet=”By charging investors for what is statistically impossible, closer indexers breached FCA’s principle of integrity!”]

And what’s the regulator charged with a statutory duty of protecting consumers doing about?

Nothing. Absolutely, nothing!

Not only has the regulator done nothing to seek redress for investors who are being robbed by these closer indexers, its proposed remedies are highly unlikely to stop this epic scandal anytime soon. The FCA’s proposed remedies amount to nothing more than increased disclosure and self-regulation (through AFM boards who are employed by asset managers), both of which it acknowledges have never worked.

Got a better idea Abraham?

You bet.

My proposal is very simple: closet index managers who have persistently underperformed while charging active fees for merely tracking the benchmark should be made to refund any fees charged over and above index fund fees. This refund will cover every year since the inception of the fund, unless otherwise prevented by the statute of limitation.

Hmm? Yup, you read that right. PPI treatment for closet indexers!

Years ago, when the banks sold millions of people a useless product called Payment Protection Insurance (PPI), the then regulator FSA directed banks to review all PPI cases and award redress to consumers. The banks challenged the regulator in court and lost. They have since paid out well over £25bn in compensation.

Recently, the FCA also directed annuities providers to review non-advised annuity sales and where appropriate, compensate thousands of people.

So, there is clear precedent for this. Which begs the question, why is the FCA letting asset managers off the hook on this epic scandal that costs investors an estimated £1billion a year?

Personally, I think the regulator’s inactivity is simply kicking the inevitable can down the road. There are already talks of class actions against closer indexers

The FCA has done a great job identifying a major failing in the asset management sector in this interim report but that only half the job. When it comes to addressing them, there’s a real danger the regulator is all hat and no cattle!

I couldn’t agree with you more Abraham. I think there is a case for a class action and going back to stakeholder days in particular. Nearly all of the group pensions we arranged for our employer clients were established as stakeholder with a maximum 1% charge often falling to 0.75% or below when fund size was sufficient, this was achieved by the providers by using passives, but was done transparently. The only plans we established as group personal pensions were on the same 1% model, but offered assess to some active funds where the AMC was higher, but they WERE active funds, not closet trackers like some providers offerred to gain market share along with massive commissions.

Since the F-pack ignore the Lonsgtop for advisers, the statute of limitations will surely NOT apply for providers as they KNOWINGLEY have breached many of the FSA/FCAQ principles and this ahs been ongoing unlike the original advice to enter which may well have been one off.

All for this initiative – some IFAs may wish to check their PII cover if they have recommended any of the funds within that astonishing figure of £142b!